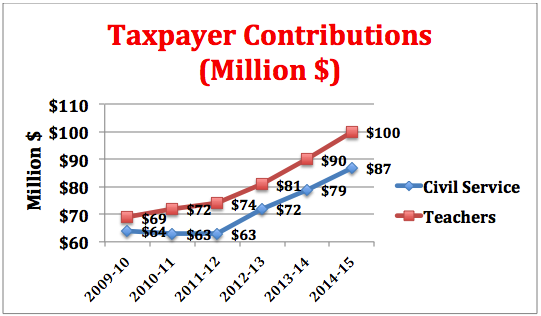

Provincial Pension Bailout Costs Skyrocketing

- Civil service pension plan: 38% increase in amount taxpayers put in over last three years

- Teachers' pension plan: 35% increase in amount taxpayers put in over last three years

The Canadian Taxpayers Federation (CTF) is again calling on the provincial government to protect taxpayers by initiating government employee pension reform. Over the last three years, the amount taxpayers put into the civil service pension plan and the teachers' pension plan has increased by 38 per cent and 35 per cent respectively.

In 2012, the government started making what appeared to be small changes to the contribution rates it put into employee pension plans. For example, for the civil service pension plan the government previously put the equivalent of 6.5 per cent of employee earnings into the fund. This July 1, the amount will rise to 7.5 per cent. While the numbers look small, the graph below shows the cost to taxpayers is enormous after all the calculations are made:

Annual Taxpayer Contributions by Plan

Note: 2013-14 figures are estimates, 2014-15 figures provided during provincial budget lock-up

“Like a lot of peoples’ RRSPs, the government employee pension funds have had shortfalls,” said CTF Prairie Director Colin Craig. “But unlike peoples’ RRSPs, the government is bailing these pension plans out with more money each year. It’s time to start putting government employees into a less costly type of plan that protects taxpayers from bailouts.”

The CTF called on the government to do three things:

1) Lead by example and switch MLAs back to a less costly defined-contribution pension plan.

2) Do what Saskatchewan's NDP government did in the late 1970s and begin putting new employees into less risky defined-contribution plans; this type of plan protects taxpayers from bailouts.

3) Follow New Brunswick’s lead for “targeted-benefit” clauses for existing plans.

Craig noted 2012 Statistics Canada data that showed 71.3 per cent of non-government employees in Manitoba didn’t have a workplace pension. Only 12.4 per cent of non-government employees had the expensive type of plan (defined-benefit) currently available to government employees.

.