MB: A Quick Briefing on Taxation in Winnipeg

A while ago I put together some information on the burden taxpayers (including businesses) face in Winnipeg.

I figured I would post the info as both voters and candidates might find the info handy as they consider who to vote for, or in the case of candidates, what to include in their platforms.

In short, I think it’s safe to say the Winnipeg taxpayer is pretty tapped out right now. It’s time for city hall and other levels of government to spend more time going after wasteful and inefficient spending rather taxpayers’ pockets.

PS – Thanks to a “little bird” for pointing out a good KPMB study on business tax comparisons.

PPS - My apologies for the formatting...some things look better in editors than they look after hitting "publish."

>>>

City Hall’s Track Record:

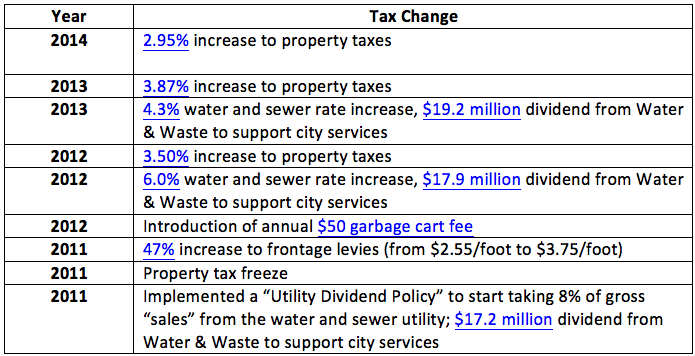

The city’s burden on Winnipeggers has been increasing faster than the rate of inflation over the last few years.

While city officials point to a long property tax “freeze” and reports that show Winnipeg in a good position compared with other cities, it should be noted that the city has raised revenues through alternative means:

- Substantially increasing water and sewer rates and then taking “dividends” from the Water and Waste Utility to pay for core city services

- Raising frontage levies; 47% in 2011 alone

- Introducing a new annual garbage cart fee

The City of Winnipeg’s Recent Taxation History at a Glance

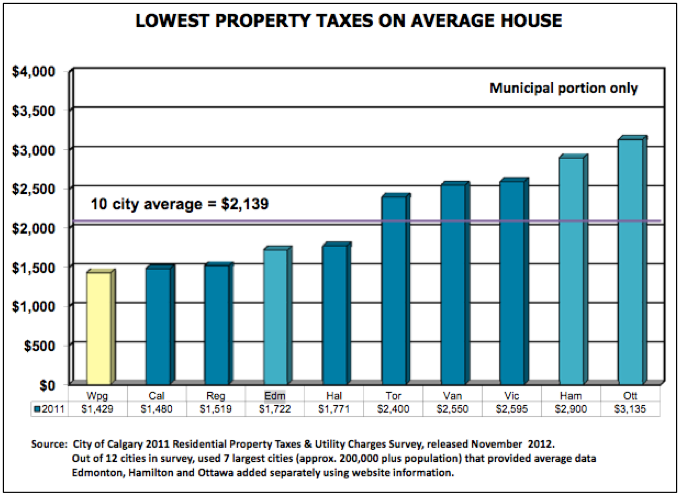

To justify the claim the city’s property taxes are competitive with other jurisdictions, city officials often point to a City of Edmonton property tax report and a survey by the City of Calgary as evidence.

The chart below appeared in the City of Winnipeg’s 2013 budget and is based on numbers from the City of Calgary. However, the chart neglects to note that housing values and incomes are higher in almost all of the other cities in the bar graph.

Going forward, the city announced in the 2013 budget that it would increase property taxes by at least 1% over the coming decade and dedicate the funds to infrastructure.

In terms of taxes paid by businesses, they not only pay property taxes and school taxes, they also have to pay an Education Support Levy (second school tax) and a Municipal Business Tax (a second property tax). The latter is levied at the rate of 5.7% times the firm’s annual rental value.

A couple articles on this subject that are worth a read:

http://www.winnipegsun.com/2012/02/29/city-should-come-clean-on-sewer-rates-brodbeck

http://www.winnipegsun.com/2012/03/24/time-to-pay-winnipeg

What has been happening with taxes in Winnipeg more broadly?

The provincial government levies some of the highest personal income taxes in Canada. Below is a table of tax comparisons using Ernst and Young’s Personal Income Tax Calculator for 2014:

.png)

In terms of total sales taxes (GST & Provincial Sales Tax), Manitoba is the highest in Western Canada, but middle of the pack nation-wide:

.png)

It should also be noted that property taxes in Manitoba also include school taxes. For a lot of properties, people pay more in school taxes than they do to municipal governments. During the last few years, school divisions have been raising taxes substantially. Here are the tax increases for the Winnipeg School Division:

2014: 3.6%

2013: 6.7%

2012: 7.8%

Manitoba does not have a small business tax, however the province’s threshold for the general business tax rate kicks in at a low threshold ($425,000) compared with the federal government and Saskatchewan ($500,000).

The existence of a payroll tax is a particular deterrent to businesses looking to expand and invest in Manitoba. Known as the Health and Post Secondary Education Tax Levy, the tax is applied at the rate of 4.3% on a business’s payroll above $1.25 million and below $2.5 million. For firms with a payroll above $2.5 million, a rate of 2.15% is charged.

It should also be noted that while Manitoba Hydro's rates are quite competitive with other jurisdictions, they are expected to rise by 4% per year over the next couple decades.

Overall, KPMG's 2014 Competitive Alternatives report ranked Winnipeg 14th out of 15 major cities when it comes to competitiveness in terms of the total effective tax rate faced by businesses.

In a future blog, I'll explore the spending side of the ledger a bit more closely.