BC: Fun and Games with the MSP Tax

I’m pleased to report that our work on the Medical Services Premium (MSP) tax is gaining momentum.

On Wednesday, one day after the BC Budget and in the thick of our criticism of the minor changes announced by the government, Premier Christy Clark said this (via CKNW):

“There is more to do though and you will see more in the next budget… MSP has grown up over a lot of years and it hasn’t grown up into a system that is entirely fair or that is even logical.”

Well, she’s right on that. If only she had the power to fix it… (oh wait!)

Anyway, on Saturday, The Vancouver Sun joined the cause with a scathing editorial backing our position on MSP. An excerpt:

The magic smoke has dissipated. The mirrors have stopped reflecting self-congratulatory images. The dogs and ponies of the budget show have departed for wherever they are kept between throne speeches. And we’re still here, the rubes staring at a Medical Services Plan that belongs in a sideshow tent beside the Amazing Chicken that does calculus.

As the Canadian Taxpayers Federation wittily observed, you can put as much lipstick on the MSP pig as you like but it’s still a pig. Promising that it will tap dance once you pay your penny — or in the case of some seniors’ MSP premiums, your $1,872 — to get inside the tent, doesn’t mean it will. The tap dancing, in fact, is being done by the grinning tax collector, exit right.

It’s easy to be distracted by the lipstick — kids will no longer be charged MSP premiums! — and lose sight of that tax collector dancing away with the silk purse fashioned from the sow’s ear. The fact is, many people who can ill afford it will pay more for their medical insurance. Over the last five years, MSP premiums have increased by 40 per cent, the CTF notes. In the same period, says the Bank of Canada, the average rate of inflation was 1.45 per cent. Seniors on fixed incomes don’t need the Amazing Chicken to do that calculation.

British Columbia is the last province in Canada to push the tired fiction that charging people premiums is a money-saving educational tool that’s validated because it reminds people that health care is not free. No, health care is not free. Citizens pay for every nickel of it. And we don’t need a tax masquerading as a pig in lipstick to painfully remind us of that fact. Roads and sidewalks are not free, either. Who needs user fees that rise at rates which vastly outstrip inflation to remind them?

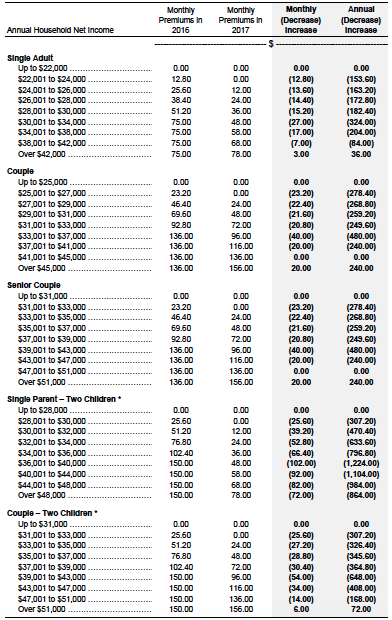

Finally, one more point on the cynical nature of the Liberals’ “Kids-are-MSP-free” announcement. Below is the actual chart included in the BC Budget document, outlining the change in MSP rates. At first glance, it looks great: nearly every line sees a reduction in MSP tax. But look closer – the income slivers are miniscule, sometimes just a couple of thousand dollars. So while it looks like a majority of people will save money, it’s just not true.